A Guide to Help to Buy - Wales

We know it can be hard to save for a house deposit, which is why we are proud to be part of Help to Buy – Wales.

Help to Buy – Wales is a scheme created by the Welsh Government, where they provide an equity loan, to help you buy a newly built home.

Help to Buy – Wales helps you to purchase a new build property from a registered home builder, up to the value of £250,000. The Welsh Government will provide you with an equity loan, up to 20% of the market value of the home.

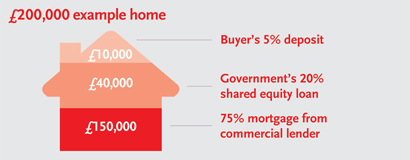

Help to Buy – Wales is made up of 3 parts:

- You have a deposit of at least 5% of the property price

- The Welsh Government provides an equity loan for up to 20% of the purchase price of the property

- You secure a repayment mortgage for the remaining balance

Example:

For the first 5 years, the equity loan is interest free, but you’ll have to pay a monthly management fee of £1.

From the 6th year, you’ll have to pay the monthly management fee of £1, plus a monthly interest fee of 1.75% of the equity loan each month. This interest rate will rise each year, in April, by the Consumer Price Index (CPI) + 2%. You’ll continue to pay interest until the loan is repaid in full.

You must also repay the equity loan, either in full or part repayments, before the end of the of the equity loan term. This is usually 25 years.

You could be eligible for Help to Buy – Wales if you:

- are buying a new-build property up to the value of £250,000 from a registered builder

- have a minimum 5% personal deposit

- can afford the repayments on a 75% loan to value repayment mortgage

- are buying your only property for personal residence and are not planning to sub-let any part of the home

Help to Buy – Wales has certain terms and conditions and affordability criteria.

Full details can be found on the Welsh Government website.

- Find and reserve your new home with a builder who is registered with the Help to Buy – Wales scheme

- Consider speaking to a financial adviser to make sure you can pay back the equity loan, as well as your mortgage

- Submit an application to Help to Buy – Wales Ltd

- Help to Buy – Wales Ltd will check your eligibility for the scheme and whether you could afford the repayments on a repayment mortgage

- If you are eligible and pass the affordability criteria, Help to Buy – Wales Ltd will send you, your solicitor and the builder approval

- You will need to apply for a repayment mortgage with a registered lender

- If your mortgage application results in an offer from the lender, you’re nearly there. Contracts can be exchanged, funds transferred and the sale is complete.

To find out more about Help to Buy – Wales, visit the Welsh Government website.